During a webinar organized by the sectorial brand ChilePork, the international analyst explained how the global economic and political scenario, also impacted by ASF and Covid-19, affect and reconfigure the markets and the future of proteins worldwide.

Today, Thursday, October 22nd, at 10:00 a.m. in South Korea and Japan (10:00 p.m. on the 21st in Chile), the second webinar in a series of three was held. It was entitled “The future of protein worldwide.” The webinar series is organized by the sector brand ChilePork to keep contact with trading partners in Japan and South Korea, while offering tools to facilitate the marketing and promotion of Chilean pork in Asian markets. The keynote speaker for this new edition was Brett Stuart, President of Global AgriTrends, researcher and analyst on global meat trade, as well as advisor to organizations such as the U.S. Meat Export Federation (USMEF). The expert offered a relevant update on the global pork market and various outlooks. Stuart analyzed numerous countries from an economic, political, and social viewpoint, also illustrating the importance of Chinese pork imports in the global economy and how the Asian country’s needs and decisions -within this ASF and Covid scenario- impact the economy of every continent.

Brett Stuart started by saying that China has reshaped the global pork export scenario due to the African swine fever (ASF), and he argued that because of the virus resistance and the structure of the pork sector in the Asian country, 50% of its hog population had been lost, basically driving hyperinflation in the sector. As rescue measures, the Chinese pork industry promoted a plan to fight the disease at plants and farms that was based on ensuring strict biosecurity measures at the entrance and exit levels. On the other hand, this hyperinflation stimulated the construction of new projects by eight large companies in various Chinese cities. In Stuart’s opinion, ASF caused the sharpest supply gap in 2020, leading the gradual recovery to cause price increases. Meanwhile, China’s situation will not recover as quickly as the Asian giant has reported, which leads to wonder when an effective vaccine for ASF will be available.

The Chinese government announced a recovery in 2020, the expert thinks it will be slower

“It will take China years to get back to where it was. They really need a vaccine,” the co-creator of Global AgriTrends said bluntly. Stuart explained that ASF is still a prevalent disease in the Asian giant, and that possibly not all of the more than 40 million pig farms in China are bio-secure. “Hyperinflation has not caused social tension or instability but it is enriching large farmers and fueling expansion,” he said. “By only allowing ‘a few’ imports, they are trying to prevent inflation of pork prices abroad. However, the demand of the Chinese population is so high that their imports continue to rise,” stated the expert. He went on to say that global meat and protein producers are likely to experience an abrupt adjustment, and that the global pork sector will shrink due to China’s expansion aimed at reinvigorating its economy.

“There is nowhere on earth to sell an additional 21 billion dollars of protein next year,” he said, “however, Chinese pork prices are still almost four times higher than those from the United States and other competitive producers. This means there is still a shortage of this protein in the Eastern country, which is yet to propose a real solution for fighting ASF. Currently, China buys 7% of US pork production. Besides, Chinese pork prices will remain above 28 RMB/kg until 2021,” Stuart said. According to figures from AgriTrends, the highest amount of pork China ever imported from the US was 50,000 metric tons in January of 2012, followed by 35,000 in January 2017.

Last January, they imported the record figure of more than 85,000 metric tons (that month alone) just from the US, which represents a million hogs. According to the data provided by Stuart, China has not met its demand since 2018 (by comparing its imports and production, it has a 24 million ton deficit). “So, what if I’m wrong?,” Brett Stuart asked. “Still, China will have bought an additional 2 million tons of pork in 2020,” he stated. Between January 2019 and August 2020, Chinese pork imports from Spain, Germany, the US, Brazil, Canada, and Denmark, among other countries, tripled in most cases. Spain, for example, went from 30,000 metric tons in January 2019 to 90,000 in August 2020. Chile is positioned as the eighth pork exporter worldwide (with 2% of total exports of this protein), after the US, Canada, Spain, Germany, Brazil, Denmark, and the Netherlands. Since September 2020, Germany has been out of the exporting market. For now. When providing an outlook on the global economy, Stuart said “the IMF forecast from last June shows a strong recovery in 2021, but a deeper decline in 2020…”

ASF in Germany and the European scenario, Covid and the global scenario

Brett Stuart talked about the ASF situation in Germany, saying that the country is temporarily out of the global market because the disease entered the country (70 cases). “If the virus continues to spread throughout the European Union and cannot be properly controlled, it will become a major issue that will change the scenario,” he said. The next question Stuart answered was related to Covid-19 and the global pork market. The analyst shared some figures to illustrate the evolution of the retail and foodservice market in the US, in millions of dollars. “Today, there is no spending in restaurants. Hence, there has been an explosive demand increase in the retail channel,” he said, and continued, “in this sense, the pork market has changed because the consumer has better access to (cheaper) pork in retail.” According to Stuart, this situation is beneficial in terms of total product demand. He also explained how the upcoming US presidential election could affect the pork market, outlining the potential scenarios depending on which candidate (Biden or Trump) is elected. “Biden will keep the pressure on China, but he will be more inclined to build a coalition. However, trade policy will change more slowly with a change in power. Both Chinese pork demand and imports will continue,” he said, “but, what will happen with the 25% retaliatory tariffs on US pork?,” he left the question open. “If Trump is reelected, it will be more of the same,” he stated.

China increases Covid-19 testing and says the virus is entering in imported frozen foods

In the final section of his presentation, Stuart revealed potential risks for the pork market, and provided some figures on the elimination of Chinese plants that followed the Covid-19 outbreak. He recounted that on September 24th, the Qingdao Health Commission reported that two asymptomatic Covid-19 carriers were working as dockworkers at a port facility. The cases were detected while performing routine testing on at-risk personnel. The authorities quickly moved 147 close contacts of the two asymptomatic carriers into quarantine. More than 10 million people were tested in four days, according to the Chinese government. Early test results indicate that the situation is likely under control, thanks to the rapid tracing.

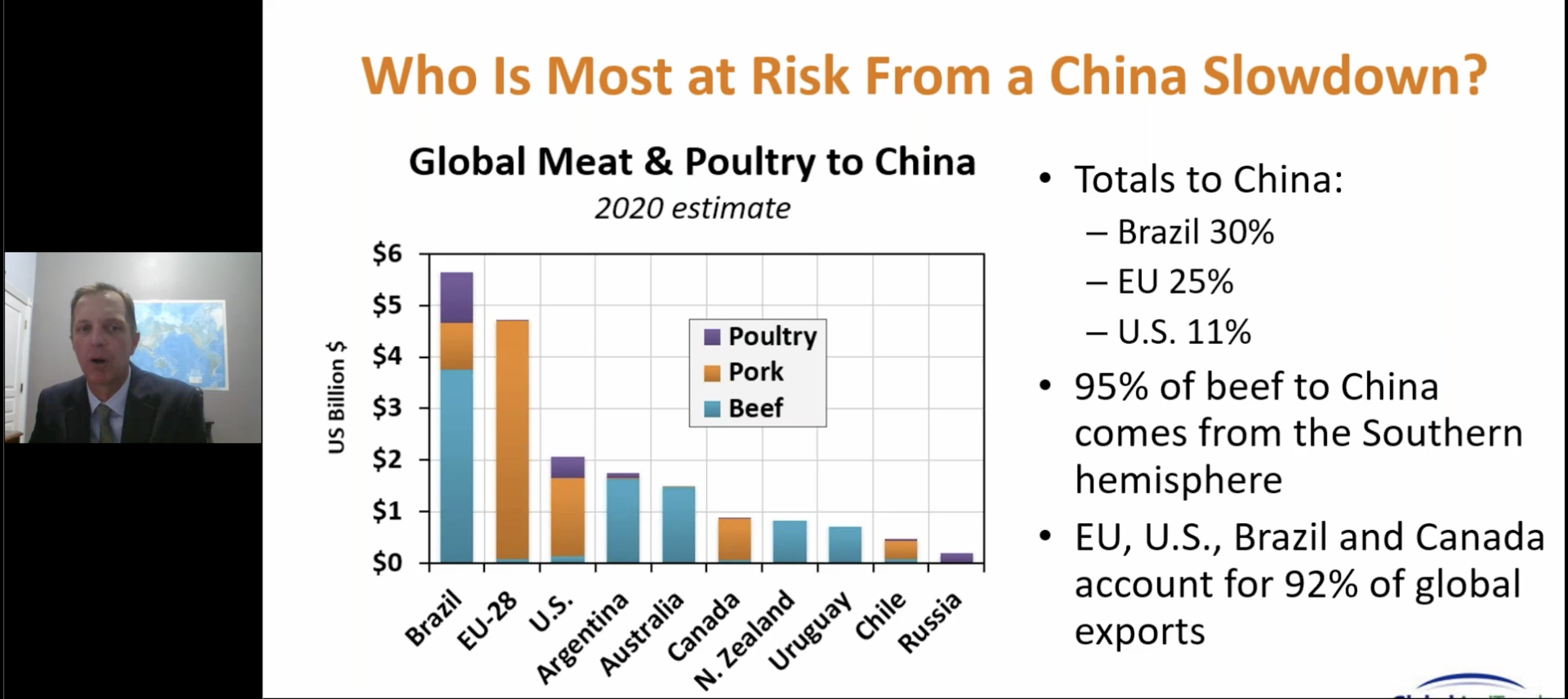

Stuart stated that food products imported via cold chain are being increasingly picked and scrutinized by the Asian country after this situation. As a result, Stuart said that China is currently the only country pushing for increased testing on imported meat and poultry (mainly frozen). “Maybe China has other motives,” he said during the final Q&A round, “just like the situation with the US, which is very political,” he pointed out. As for exporting countries with a higher decline risk in China (red and white meat shipments), he mentioned Brazil, with 30%, the European Union, with 25%, and the US, with 11%. The EU, the US, Brazil, and Canada make up 92% of world exports. Regarding change factors for 2021, the expert said that everything matters: China’s prices, plant closures, and politics. He noted that these are the three “global protein drivers.” What about the slowdown, will it be temporary? He left the question open. Will there be another US stimulus for this market? Probably before the presidential election, he said. Yet, the world still needs a lot of pork, and countries with good biosecurity standards are there to respond.

After the Q&A round, the webinar ended with a video from the next speaker for ChilePork’s webinar series, Ken Hughes (on October 29th). He will explain how to sell and consume in the so-called “new normal.” Regarded as one of the world’s leading authorities in consumer, buyer, and online buyer behavior, Hughes will talk about the changes in pork consumption and buying trends in the main sales channels, and how sales and promotion strategies will change at the various points of sale under the new normal.